Joining Benefits of Axis Bank Reserve Credit Card

- Welcome Benefit:

Luxury gift voucher worth ₹50,000 upon card activation.

- Reward Points:

Earn 15 EDGE Reward Points for every ₹200 spent on all transactions.

- Milestone Benefits:

Earn 50,000 bonus EDGE Reward Points on reaching annual spend milestones.

- Airport Lounge Access:

Unlimited complimentary access to domestic and international airport lounges for both primary and add-on cardholders.

- Travel Benefits:

Complimentary Priority Pass membership providing access to over 1,000 airport lounges worldwide.

Special discounts on luxury hotel stays, car rentals, and flight bookings.

Complimentary international travel insurance covering air accident, medical emergencies, trip cancellations, and lost baggage.

- Dining Privileges:

Up to 20% off at select premium restaurants through Axis Bank’s Dining Delights program.

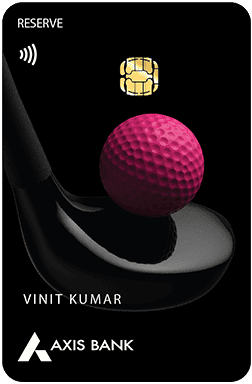

- Golf Privileges:

Complimentary golf rounds and lessons at select golf courses in India and abroad.

- Wellness and Lifestyle Benefits:

Complimentary access to premium spas, wellness centers, and fitness clubs.

Exclusive access to luxury events, shows, and experiences curated for cardholders.

- Fuel Surcharge Waiver:

1% waiver on fuel surcharge at all petrol pumps across India.

- Annual Fee Waiver:

No annual fee waiver, but the substantial benefits and rewards effectively offset the fee for high spenders.

- Concierge Services:

24/7 global concierge service for travel, dining, entertainment, and lifestyle arrangements.

- Interest-Free Period:

Up to 50 days of interest-free credit on purchases.

- Security Features:

Advanced security features including EMV chip technology, contactless payments, and zero liability on lost card.

Card Features and Benefits

Travel & Lounge Benefits

The Axis Bank Reserve Credit Card offers an array of travel-related perks, making it an ideal companion for frequent travelers. Key benefits include:

- Unlimited Lounge Access: Cardholders enjoy unlimited complimentary access to international and domestic airport lounges through the Priority Pass membership. This benefit extends to both primary and add-on cardholders, with an additional 12 free guest visits per year.

- VIP Assistance Services: Cardholders are entitled to eight free VIP Assistance Services annually, which streamline airport procedures like check-in, security checks, and immigration, ensuring a hassle-free travel experience.

- Low Forex Markup: A forex markup fee of just 1.5% makes it highly economical for international travelers compared to standard credit cards that charge around 3.5%.

Hotel Benefits

The Axis Bank Reserve Credit Card enhances the luxury travel experience by offering complimentary memberships to elite hotel programs:

- ITC Culinaire Membership: Includes a free third-night stay, 50% off on suites during weekends, and 25% Green Points on F&B spends, among other benefits.

- Accor Plus Membership: Offers one free night stay across the Asia Pacific region, up to 50% off on dining, and complimentary room upgrades.

- Club Marriott Membership: Provides a 20% discount on food, beverages, and best available room rates at select Marriott hotels across India and the Asia Pacific region.

- Oberoi Hotels and Resorts: Cardholders receive a 15% discount on room rates and a 50% discount on suites.

Rewards Program & Redemption

The Axis Bank Reserve Credit Card offers a robust rewards program with the following features:

- Earning Rates: Cardholders earn 15 Edge Reward Points for every ₹200 spent on domestic purchases, and double the points for international transactions.

- Redemption Options: Points can be redeemed for vouchers, travel miles, or hotel loyalty points. However, recent changes have reduced the point-to-mile conversion ratio from 5:4 to 5:2, and introduced caps on miles transfer, affecting the overall redemption value.

- Exclusions: Certain categories, including insurance, fuel, gold/jewelry, and utility payments, do not earn rewards points, which can limit the card’s utility for some users.

Golf and Lifestyle Benefits

For golf enthusiasts and lifestyle connoisseurs, the card provides:

- Complimentary Golf Rounds: Cardholders receive 50 free rounds of golf annually at select courses across India, a benefit that is hard to match by other cards.

- Luxury Concierge Services: 24/7 concierge service is available to assist with travel bookings, dining reservations, event planning, and more.

Health, Wellness, and Insurance Coverage

The Axis Bank Reserve Credit Card also focuses on the health and wellness of its cardholders with the following benefits:

- Health Coaching: Access to wellness coaching services, including a free initial consultation and discounts on further sessions.

- Comprehensive Insurance Coverage: The card includes a variety of insurance protections, such as lost card liability (up to the credit limit), purchase protection (up to ₹2 lakh), and coverage for loss or delay of baggage and personal documents (up to USD 500).

- Credit Shield: Offers up to ₹5 lakh in coverage, which clears the outstanding balance in the event of the primary cardholder’s demise.

Rewards Program

The rewards program of the Axis Bank Reserve Credit Card is designed to cater to high spenders, particularly those who frequently travel or make large purchases. Despite recent devaluations, the program still offers competitive earning rates and several redemption options, although its value proposition has been somewhat diminished. Here’s a detailed look at how the rewards program works:

Earning Reward Points

- Domestic Spending

- 15 Edge Reward Points per ₹200: For every ₹200 spent on domestic transactions, cardholders earn 15 Edge Reward Points. This translates to a base reward rate of 7.5 points per ₹100, making it a strong contender among premium cards, especially for high-value purchases.

- International Spending

- 30 Edge Reward Points per ₹200: For every ₹200 spent in foreign currency, cardholders earn 30 Edge Reward Points. This is double the rate of domestic spending, offering substantial rewards for frequent international travelers.

- Excluded Categories

- No Rewards on Certain Categories: Spending on insurance, fuel, gold/jewelry, wallet recharges, government institutions, and utility payments does not earn reward points. This limits the card’s utility for everyday spending in these categories.

Redemption Options

- Voucher Redemption

- EDGE Rewards Portal: Accumulated points can be redeemed for vouchers from a wide range of brands through the Axis Bank EDGE Rewards Portal. The value of redemption varies, typically around ₹0.20 per point, depending on the brand and voucher chosen.

- Air Miles Conversion

- Point-to-Mile Conversion: The card allows conversion of Edge Reward Points to air miles at a ratio of 5:2 (5,000 points = 2,000 miles). This ratio is less favorable compared to other super-premium cards like HDFC Infinia, which offers a 1:1 conversion.

- Transfer Partners: Points can be transferred to various airline and hotel loyalty programs, which are now categorized into Group A and Group B with specific transfer caps:

- Group A: Premium partners like Singapore Airlines KrisFlyer, Marriott Bonvoy, with a cap of 1 lakh points per year.

- Group B: Includes other partners with a cap of 4 lakh points per year.

- Pay with Points

- Direct Payment Option: Cardholders can use points to directly pay for purchases at select merchants through the Pay with Points option. The value here is generally lower, around ₹0.20 per point, making it less attractive than miles conversion for maximizing value.

Redemption Value Comparison

- Axis Bank Reserve vs. Competitors: Compared to cards like HDFC Infinia (1:1 conversion) or American Express Platinum (1:1.2 on selected airlines), the Axis Reserve’s 5:2 conversion ratio is less competitive, particularly for users who prioritize air miles. This makes the card less appealing for those who seek to maximize travel rewards.

Annual Points Cap

- Capping on Points Transfer: The total capping on rewards redemption for miles or hotel points is set at 5 lakh points per year. With the new division into Group A and Group B, cardholders face additional restrictions, particularly if they are loyal to specific brands or airlines in Group A.

Welcome and Renewal Points

- Welcome Points: Cardholders receive 15,000 Edge Reward Points upon activation of the card, providing an immediate boost to their points balance.

- Renewal Points: Previously, the card offered 50,000 Edge Reward Points upon renewal, but this benefit has been discontinued as part of recent devaluations, reducing the long-term value of maintaining the card.

Pricing and Plans

The Axis Bank Reserve Credit Card is a premium offering that comes with significant fees, which are justified by its extensive benefits tailored to high-net-worth individuals. Below is a breakdown of the key fees and charges associated with this card:

Joining and Annual Fees

- Joining Fee: ₹50,000

- Annual Fee: ₹50,000 (This fee is waived if the cardholder's annual spending exceeds ₹35 lakh)

These fees reflect the card’s super-premium status and are aligned with the high-end benefits it offers, particularly in the travel and luxury lifestyle segments.

Supplementary Card Fees

- Supplementary Card Joining Fee: None

- Supplementary Card Annual Fee: None

The lack of fees for supplementary cards makes it easier for primary cardholders to extend benefits to family members without incurring additional costs.

Finance Charges

- Finance Charges on Cash and Retail Purchases: 2.95% per month (41.75% per annum)

This interest rate is relatively high, which is typical for credit cards. However, it underscores the importance of paying off balances in full each month to avoid substantial finance charges.

Cash Withdrawal Fees

- Cash Withdrawal Fee: 2.5% of the amount withdrawn, with a minimum fee of ₹250

This fee applies to any cash advances taken on the card. Given the high interest rates, it’s advisable to avoid using the card for cash withdrawals unless absolutely necessary.

Payment and Replacement Fees

- Fee for Making Payment in Cash: ₹100

- Card Replacement Fee: Waived

- Duplicate Statement Fee: Waived

The waiver of replacement and statement fees enhances the convenience for cardholders, particularly in managing lost or damaged cards.

Late Payment Fees

- Late Payment Fee:

- ₹300 if the total payment due is up to ₹2,000

- ₹400 if the total payment due is between ₹2,001 and ₹5,000

- ₹600 if the total payment due is ₹5,001 or more

Late payment fees are tiered based on the outstanding amount, which encourages timely payments to avoid penalties.

Over-Limit and Other Penalties

- Over Limit Penalty: 3% of the over-limit amount (minimum of ₹500)

- Cheque Return Fee: ₹300

- Surcharge on Purchase or Cancellation of Train Tickets: As prescribed by Indian Railways or IRCTC

These charges are standard for credit cards, emphasizing the importance of managing credit limits and avoiding returned payments.

Transaction Fees

- Fuel Transaction Surcharge: 1% of the transaction amount (refunded for transactions between ₹400 and ₹4,000)

- Foreign Currency Transaction Fee: 3.50% of the transaction value

The foreign currency transaction fee is relatively high, which is a consideration for frequent international travelers. However, the card’s other travel benefits may offset this cost to some extent.

Additional Fees

- Mobile Alerts for Transactions: Waived

- Hotlisting Charges: Waived

- Balance Enquiry Charges: Waived

- Copy Request Fee or Charge-Slip Retrieval Fee: Waived

- Outstation Cheque Fee: Waived

User Experience

The user experience of the Axis Bank Reserve Credit Card is shaped by its premium positioning and the range of services it offers. Below is an overview of what cardholders typically experience when using this card:

1. Application Process

- Smooth Application: The application process for the Axis Bank Reserve Credit Card is generally straightforward, especially for existing Axis Bank customers. High-net-worth individuals often receive personalized service through their relationship managers, ensuring a seamless experience from application to approval.

2. Customer Support

- Dedicated Support: Cardholders have access to dedicated customer support, often through specialized teams that handle premium customers. This includes faster response times and more personalized service, which is crucial for resolving issues quickly and efficiently.

- Concierge Service: The 24/7 concierge service is a standout feature, providing assistance with various tasks that enhance the cardholder’s lifestyle, from making travel arrangements to securing last-minute reservations at exclusive venues.

3. Reward Redemption

- Ease of Redemption: The Axis Bank EDGE Rewards platform is user-friendly, allowing cardholders to easily redeem points for a wide range of options, including vouchers, air miles, and hotel stays. However, some users may find the reduced point-to-mile conversion ratio and the new caps on miles transfer slightly limiting.

4. Travel and Lounge Access

- Premium Travel Experience: Frequent travelers benefit significantly from the unlimited lounge access, both domestically and internationally. The inclusion of guest access further enhances the experience, making travel more comfortable and convenient for the cardholder and their companions.

5. Overall Usability

- Widely Accepted: As a Visa Infinite card, the Axis Bank Reserve Credit Card is widely accepted both in India and internationally. The card’s low forex markup fee of 1.5% makes it particularly useful for international purchases.

- Mobile App and Online Access: Axis Bank’s mobile app and online banking platforms are robust, providing easy access to account details, transaction history, and reward redemption options. This digital convenience is essential for managing a high-limit card effectively.

6. User Feedback

- High Satisfaction Among High-Spenders: Users who can leverage the card’s full range of benefits, especially in travel and luxury services, generally report high satisfaction. The premium hotel memberships, extensive lounge access, and concierge services are particularly well-received.

- Mixed Reactions to Recent Devaluations: Some cardholders have expressed concerns over the recent devaluations, particularly the reduced value in the rewards program. These changes have led some users to reevaluate the card’s overall value proposition.

Comparative Analysis

| Feature/Benefit | Axis Bank Reserve | HDFC Infinia | HDFC Diners Club Black | SBI Card Aurum | American Express Platinum |

|---|---|---|---|---|---|

| Annual Fee | ₹50,000 (Waived on ₹35 lakh spend) | ₹12,500 (Waived on ₹10 lakh spend) | ₹10,000 (Waived on ₹5 lakh spend) | ₹10,000 (Waived on ₹12 lakh spend) | ₹ 60,000 |

| Reward Points | 15 RP/₹200 (30 RP on international spends) | 5 RP/₹150 | 5 RP/₹150 | 4 RP/₹100 | 1 MR Point/₹40 (except Fuel, Insurance, Utilities) |

| Point-to-Mile Conversion | 05:02 | 01:01 | 01:01 | 05:02 | 1:1.2 on selected airlines |

| Lounge Access | Unlimited (Domestic & International) | Unlimited (Domestic & International) | Unlimited (Domestic & International) | 8 international + 4 domestic visits/year | Unlimited (Domestic & International) |

| Guest Lounge Access | 12 visits/year | Not included | Not included | Not included | Included (American Express Lounges) |

| Hotel Memberships | ITC, AccorPlus, Club Marriott | Taj Epicure, ITC Culinaire | None | None | Hilton Honors, Marriott Bonvoy, Radisson Rewards, and others |

| Golf Benefits | 50 free rounds/year | Unlimited (Green Fee waived) | 6 complimentary rounds/year | 4 complimentary rounds/year | None |

| Forex Markup | 1.50% | 2% | 2% | 1.99% | 3.50% |

| Insurance Coverage | Travel, Baggage, Credit Shield, Purchase Protection | Travel, Medical, Baggage | Travel, Medical, Purchase Protection | Travel, Medical | Travel, Medical, Purchase Protection |

| Concierge Service | Yes | Yes | Yes | Yes | Yes |

| Airport Transfer | Discontinued | 8 complimentary transfers/year | 4 complimentary transfers/year | None | 2 complimentary transfers/year |

| Eligibility | High income, 750+ credit score | High income, 750+ credit score | High income, 750+ credit score | High income, 750+ credit score | High income, 750+ credit score |

Comparison Summaries

- Axis Bank Reserve vs. HDFC Infinia

- Annual Fee: The Axis Reserve has a much higher annual fee, but HDFC Infinia offers a more generous waiver threshold and a significantly lower fee.

- Rewards: HDFC Infinia provides a straightforward 1:1 point-to-mile conversion, which is superior to the Axis Reserve’s reduced 5:2 ratio.

- Travel Perks: Both cards offer unlimited lounge access, but Axis Reserve includes guest access, which is a notable advantage.

- Additional Benefits: Axis Reserve offers better hotel memberships, while HDFC Infinia provides unlimited golf access.

- Axis Bank Reserve vs. HDFC Diners Club Black

- Annual Fee: The HDFC Diners Club Black has a lower annual fee and a lower waiver threshold, making it more accessible.

- Rewards: Both cards have similar reward structures, but Diners Club Black also offers a 1:1 point-to-mile conversion, making it more attractive for travelers.

- Travel Perks: Axis Reserve offers superior hotel memberships and more golf benefits, while Diners Club Black focuses on robust travel insurance and lounge access.

- International Usage: Axis Reserve’s lower forex markup of 1.5% is better than Diners Club Black’s 2%, making it more favorable for international travelers.

- Axis Bank Reserve vs. SBI Card Aurum

- Annual Fee: SBI Aurum’s fee is lower, but the spend waiver requirement is higher relative to its fee.

- Rewards: Axis Reserve offers a more generous rewards rate, especially on international spends, compared to SBI Aurum.

- Travel Perks: Axis Reserve offers unlimited lounge access and extensive hotel memberships, whereas SBI Aurum has limited lounge visits.

- Golf Benefits: Axis Reserve clearly outshines SBI Aurum with 50 complimentary rounds versus Aurum’s 4 rounds per year.

- Axis Bank Reserve vs. American Express Platinum

- Annual Fee: American Express Platinum has a higher annual fee, reflecting its elite status and extensive global benefits.

- Rewards: Amex Platinum offers a broader range of points-earning opportunities, particularly on global spends, but the rewards structure is less straightforward compared to Axis Reserve.

- Travel Perks: While both cards offer extensive lounge access and travel perks, Amex Platinum’s global partnerships with luxury hotels and premium services make it more appealing for international travelers.

- Additional Benefits: Axis Reserve offers better golf benefits, but Amex Platinum excels in concierge services and exclusive global experiences.

Pros and Cons

The Axis Bank Reserve Credit Card is a super-premium offering with a range of high-end benefits, but like any financial product, it has its advantages and drawbacks. Below is a balanced view of the pros and cons to help you determine if this card aligns with your financial needs and lifestyle.

Pros

- Extensive Travel Benefits

- Unlimited Lounge Access: Both domestic and international lounge access are included, with additional guest passes, making it one of the best cards for frequent travelers.

- Low Forex Markup: A competitive 1.5% forex markup fee is beneficial for those who travel or make purchases abroad frequently.

- High Reward Points Earning Potential

- Enhanced Rewards for International Spending: With 30 reward points per ₹200 spent internationally, the card offers strong rewards for those who spend frequently in foreign currencies.

- Broad Reward Program: Earn 15 points per ₹200 on domestic spending, which is generous, especially when compared to other super-premium cards.

- Premium Hotel Memberships

- Multiple Elite Memberships: Complimentary memberships to ITC, AccorPlus, and Club Marriott provide discounts, free nights, and exclusive benefits, making this card particularly valuable for luxury hotel stays.

- Generous Golf Benefits

- 50 Complimentary Rounds: The card offers 50 free rounds of golf per year at select courses across India, which is significantly higher than most other cards.

- Comprehensive Concierge Service

- 24/7 Concierge: Cardholders have access to a premium concierge service that can assist with travel bookings, dining reservations, event planning, and more, adding convenience and luxury to the user experience.

- No Supplementary Card Fees

- Free Supplementary Cards: No joining or annual fees for supplementary cards make it easy to extend the card’s benefits to family members without extra costs.

Cons

- High Annual Fee

- ₹50,000 Annual Fee: This is one of the highest annual fees in the market, and while it can be waived with spending above ₹35 lakh, it still represents a significant cost for most users.

- Recent Devaluations

- Reduced Point-to-Mile Conversion: The reduction from 5:4 to 5:2 in the point-to-mile conversion ratio has significantly diminished the card’s value for frequent flyers.

- Stricter Annual Fee Waiver Threshold: The increase in the annual spending requirement from ₹25 lakh to ₹35 lakh for the fee waiver makes it harder for many to avoid this high fee.

- Limited Point Redemption Flexibility

- Capped Points Transfer: The introduction of Group A and Group B for miles transfer partners, with caps on points transfer, limits flexibility and could inconvenience those loyal to specific airlines or hotel chains.

- Exclusions in Rewards

- Certain Categories Excluded: Purchases in categories such as insurance, fuel, gold/jewelry, wallet, and utility payments do not earn reward points, reducing the overall reward potential for day-to-day spending.

- No Longer Includes Airport Transfers

- Removal of Complimentary Airport Transfers: The discontinuation of free airport transfers is a loss for travelers who valued this luxury service.

- High Interest Rates

- Finance Charges: With an interest rate of 2.95% per month (41.75% per annum), carrying a balance can become very costly, making it crucial to pay off balances in full each month.

Conclusion and Overall Rating

The Axis Bank Reserve Credit Card stands out as a premier offering in the Indian credit card market, tailored for high-net-worth individuals who value luxury, travel, and exclusive privileges. With its extensive range of benefits, including unlimited lounge access, premium hotel memberships, and generous golf perks, the card is well-suited for frequent travelers and those who enjoy a high-end lifestyle. The rewards program, while strong in terms of earning potential, has been somewhat diminished by recent devaluations, particularly the reduction in the point-to-mile conversion ratio and the introduction of caps on miles transfer.

The card’s high annual fee of ₹50,000 is justified by its premium features, though the increased threshold for fee waiver (₹35 lakh in annual spending) may make it less accessible for some. Additionally, the removal of certain benefits, such as complimentary airport transfers and renewal points, has impacted its overall value proposition.

Despite these changes, the Axis Bank Reserve Credit Card remains a strong contender in the super-premium category, particularly for those who can fully leverage its extensive travel and lifestyle benefits. However, potential cardholders should carefully consider their spending patterns and travel needs to ensure they can maximize the value offered by this card.

- Rewards Program: ★★★★☆

- Travel Benefits: ★★★★☆

- Premium Features: ★★★★☆

- Annual Fee Value: ★★★☆☆

- Customer Support and Experience: ★★★★☆

This rating reflects the card’s strengths in offering luxury travel perks and a high rewards potential, balanced against the recent devaluations and the high cost of ownership. The Axis Bank Reserve Credit Card is best suited for those who spend heavily, particularly on travel, and who can comfortably meet the fee waiver requirements.

Alternatives

If the Axis Bank Reserve Credit Card doesn't fully meet your needs, here are some alternatives that offer competitive features in the super-premium segment:

- HDFC Infinia Credit Card

- Why Consider? Lower annual fee of ₹12,500 with an easier waiver threshold and a 1:1 point-to-mile conversion ratio. It also offers unlimited lounge access and excellent rewards through the HDFC SmartBuy platform.

- HDFC Diners Club Black

- Why Consider? Similar luxury benefits with a lower annual fee of ₹10,000. Offers a 1:1 point-to-mile conversion and comprehensive travel insurance, making it ideal for frequent travelers.

- American Express Platinum Card

- Why Consider? Though it has a high annual fee of ₹60,000, it offers unmatched global privileges, including elite hotel memberships, extensive lounge access, and premium concierge services, making it perfect for international travelers.

- SBI Card Aurum

- Why Consider? A more affordable annual fee of ₹10,000 with benefits like complimentary lounge access, golf rounds, and exclusive dining privileges. It’s a good middle-ground for those who want premium perks without the high cost.