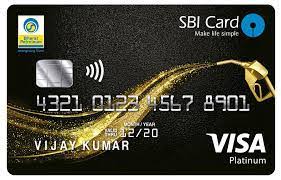

Joining Benefits of BPCL SBI Credit Card

1. Welcome Bonus: 2,000 reward points on spending ₹2,000 within the first 60 days.

2. Fuel Savings: 4.25% value back on fuel purchases at BPCL petrol pumps.

3. Reward Points: 13x reward points on every ₹100 spent on fuel at BPCL.

4. Fuel Surcharge Waiver: 1% waiver on fuel transactions.

5. Reward Points on Other Spends: 1 reward point per ₹100 spent on non-fuel retail purchases.

6. Annual Fee Reversal: Annual fee reversed on spending ₹50,000 in a year.

7. Exclusive Offers: Special discounts and offers on dining, shopping, and entertainment.

8. Easy Bill Pay: Facility to set up standing instructions for utility bill payments.

Card Features and Benefits

The BPCL SBI Credit Card offers a comprehensive suite of features and benefits tailored to meet the needs of frequent fuel purchasers while also providing value on other types of spending. Below is an in-depth look at the key features and benefits of this card:

Welcome Gift

- Activation Bonus: Receive 2,000 bonus reward points worth Rs. 500 upon payment of the joining fee. These points can be redeemed for fuel purchases at BPCL outlets or through the Shop n Smile rewards catalogue.

- Reward Points Crediting: The activation bonus reward points are credited 20 days after the payment of the joining fee.

Value Back Benefits

- Fuel Purchases: Earn 4.25% value back (equivalent to 13X reward points) on fuel purchases at BPCL petrol pumps. This includes a 3.25% reward plus a 1% fuel surcharge waiver on transactions up to Rs. 4,000, exclusive of GST and other charges.

- Monthly Cap: A maximum of 1,300 reward points can be earned per billing cycle for fuel transactions.

Reward Benefits

- Category-Specific Rewards: Earn 5X reward points on every Rs. 100 spent on groceries, departmental stores, movies, and dining, up to a maximum of 5,000 reward points per month.

- General Spending: Earn 1 reward point for every Rs. 100 spent on non-fuel retail purchases.

Fuel Freedom Benefits

- Valueback on Fuel: Enjoy a 4.25% value back (13X reward points equivalent to 3.25% reward points plus a 1% fuel surcharge waiver) on every transaction up to Rs. 4,000 at any BPCL petrol pump.

- Surcharge Waiver: Avail a maximum fuel surcharge waiver of Rs. 100 per billing cycle, translating to an annual saving of up to Rs. 1,200.

Additional Features

- Contactless Advantage: Make secure, fast, and convenient transactions by simply waving the card at a secure reader without handing it over.

- Worldwide Acceptance: Use the card at over 24 million outlets worldwide, including 325,000 outlets in India, wherever Visa or MasterCard is accepted.

- Add-on Cards: Empower family members with add-on cards for parents, spouse, children, or siblings above 18 years of age.

- Utility Bill Payment: Pay electricity, telephone, mobile, and other utility bills using the Easy Bill Pay facility.

- Balance Transfer on EMI: Transfer outstanding balances from other credit cards to the BPCL SBI Card at a lower interest rate and repay in easy EMIs.

- Flexipay: Convert transactions of Rs. 2,500 or more into monthly installments within 30 days of purchase through the Flexipay feature.

Fees and Charges

Understanding the fees and charges associated with the BPCL SBI Credit Card is crucial for maximizing its benefits and managing costs effectively. Here is a detailed breakdown of the applicable fees and charges:

Joining and Renewal Fees

- Joining Fee: Rs. 499 plus applicable GST.

- Renewal Fee: Rs. 499 plus applicable GST, charged annually from the second year onwards.

- Renewal Fee Waiver: The renewal fee is reversible if the cardholder's annual spending in the preceding year is Rs. 50,000 or more.

Add-on Card Fee

- Annual Fee for Add-on Cards: Nil. There is no additional charge for issuing add-on cards to family members.

Transaction and Service Fees

- Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver on transactions up to Rs. 4,000 at BPCL petrol pumps, capped at Rs. 100 per billing cycle.

- Balance Transfer Fee: Transfer outstanding balances from other credit cards to the BPCL SBI Credit Card at a lower interest rate and repay in EMIs.

- Flexipay Conversion Fee: Convert purchases of Rs. 2,500 or more into monthly installments using the Flexipay feature within 30 days of purchase.

Payment Settlement and Other Considerations

- Order of Payment Settlement: Payments made towards the card will be settled in a predefined order, covering fees and charges first, followed by interest, and then the principal amount.

- Cheque Payments: Only local cheques or drafts payable in Delhi are accepted for payment. Cheques payable outside clearing zones are not accepted.

- Taxes: All fees, interest, and charges are subject to applicable taxes.

Terms and Conditions

- Fee and Revenue Sharing: The fees and revenue generated from the BPCL SBI Credit Card may be shared between SBI Card and BPCL based on their financial agreement. This arrangement might impact the value proposition of the card.

- Acceptance of Amendments: Continued use of the BPCL SBI Credit Card implies acceptance of any amendments to the terms and conditions.

User Experience

The BPCL SBI Credit Card is designed to provide a seamless and rewarding experience for its users, particularly those who frequently purchase fuel. Here is a detailed analysis of the user experience associated with this credit card:

Application and Activation

- Easy Application Process: The application process for the BPCL SBI Credit Card is straightforward, with online and offline options available. Applicants can apply through the SBI Card website, by visiting an SBI branch, or through authorized agents.

- Quick Activation: Upon approval, the card is delivered promptly, and activation is simple, allowing users to start enjoying the benefits almost immediately.

Daily Use and Transactions

- Contactless Payments: The card supports contactless transactions, enabling users to make fast and secure payments by waving the card at a secure reader. This feature is especially useful for small ticket purchases and enhances convenience.

- Wide Acceptance: The BPCL SBI Credit Card is accepted at over 24 million outlets worldwide, including 325,000 outlets in India, wherever Visa or MasterCard is accepted. This extensive acceptance network ensures users can rely on the card for both domestic and international transactions.

Fuel Purchase Benefits

- Seamless Reward Redemption: The reward points earned on fuel purchases at BPCL petrol pumps can be redeemed instantly, making it easy for users to utilize their rewards without delay.

- Surcharge Waiver: The 1% fuel surcharge waiver on transactions up to Rs. 4,000 per billing cycle enhances the value proposition for users, providing tangible savings on every fuel purchase.

Additional Features

- Utility Bill Payments: Users can conveniently pay their electricity, telephone, mobile, and other utility bills using the Easy Bill Pay facility, simplifying their bill payment process.

- Add-on Cards: The provision of add-on cards allows users to extend the benefits of the BPCL SBI Credit Card to their family members, enhancing its utility.

Security and Support

- Enhanced Security: The card incorporates advanced security features, such as the unique security key for contactless transactions, reducing the risk of card loss and fraud due to skimming.

- Customer Support: SBI Card provides robust customer support, available through a dedicated helpline and online services. Users can easily resolve queries and issues, ensuring a smooth user experience.

Online and Mobile Services

- Account Management: Cardholders can manage their accounts online through the SBI Card website or mobile app. These platforms offer functionalities such as viewing statements, making payments, redeeming rewards, and more, providing users with comprehensive control over their card activities.

Additional Perks and Benefits

Beyond the core features and benefits, the BPCL SBI Credit Card offers several additional perks that enhance its value proposition for cardholders. These perks cater to various needs, providing flexibility and added convenience.

Flexipay

- Flexible EMI Options: With Flexipay, cardholders can convert transactions of Rs. 2,500 or more into easy monthly installments. This feature allows users to manage their finances better by spreading out the cost of significant purchases over time.

- Simple Booking Process: Cardholders can convert their transactions into EMIs within 30 days of purchase by logging into their SBI Card account online, making the process quick and straightforward.

Balance Transfer on EMI

- Lower Interest Rates: The Balance Transfer on EMI feature allows cardholders to transfer outstanding balances from other bank credit cards to their BPCL SBI Card at a lower interest rate. This can help users save on interest payments and pay off their dues more comfortably.

- Flexible Repayment: Users can choose from various EMI options to repay the transferred balance, providing flexibility in managing their credit card debt.

Contactless Advantage

- Convenience: The contactless payment feature offers a quick and secure way to make payments by simply waving the card at a secure reader. This is particularly useful for small, everyday purchases.

- Security: Contactless transactions reduce the risk of card loss and fraud due to skimming, as the card never leaves the user's hand. The unique security key ensures that only one transaction goes through, even if the card is waved multiple times.

Worldwide Acceptance

- Global Usability: The BPCL SBI Credit Card is accepted at over 24 million outlets worldwide, including 325,000 outlets in India. This global acceptance ensures that cardholders can use their card seamlessly, whether they are traveling domestically or internationally.

Add-on Cards

- Family Benefits: Cardholders can extend the benefits of their BPCL SBI Credit Card to family members by providing add-on cards. These cards can be issued for parents, spouse, children, or siblings above 18 years of age, enhancing the card's utility for the entire family.

- No Additional Fee: There is no annual fee for add-on cards, making it a cost-effective way to share the card's benefits.

Utility Bill Payment

- Convenient Bill Payments: Cardholders can use the Easy Bill Pay facility to pay their utility bills, such as electricity, telephone, and mobile bills, directly through their BPCL SBI Credit Card. This feature simplifies bill management and ensures timely payments.

Comparative Analysis

Comparing the BPCL SBI Credit Card with other credit cards in the Indian market helps to highlight its unique benefits and features. Here is a comparative analysis of the BPCL SBI Credit Card against similar fuel-oriented credit cards:

Pros and Cons

Pros:

- High Fuel Rewards:

- Earn 4.25% value back (13X reward points) on fuel purchases at BPCL petrol pumps, maximizing savings on fuel expenses.

- Fuel Surcharge Waiver:

- Enjoy a 1% fuel surcharge waiver on transactions up to Rs. 4,000 per billing cycle, further reducing fuel costs.

- Welcome Gift:

- Receive 2,000 activation bonus reward points worth Rs. 500, effectively offsetting the joining fee.

- Category-Specific Rewards:

- Earn 5X reward points on groceries, departmental stores, movies, and dining, providing additional value on everyday expenses.

- Flexible Reward Redemption:

- Redeem reward points for fuel at BPCL outlets or through the Shop n Smile rewards catalogue, offering flexibility in how rewards are used.

- Contactless Payments:

- Make secure, fast, and convenient transactions with the contactless payment feature.

- Additional Features:

- Benefit from Flexipay, Balance Transfer on EMI, and utility bill payments, providing financial flexibility and convenience.

- Annual Fee Waiver:

- The renewal fee is waived if the annual spending exceeds Rs. 50,000, making the card economical for regular users.

- No Add-on Card Fee:

- Issue add-on cards to family members without any additional annual fee, extending the benefits to loved ones.

Cons:

- Monthly Cap on Fuel Rewards:

- The maximum cap of 1,300 reward points per billing cycle on fuel purchases may limit benefits for heavy fuel spenders.

- Non-Fuel Reward Rate:

- The reward rate of 1 point per Rs. 100 spent on non-fuel retail purchases is relatively modest compared to other cards offering higher rates for general spending.

- Annual Fee:

- While the annual fee is moderate, it could be a consideration for users who do not meet the waiver threshold.

- Limited Surcharge Waiver:

- The fuel surcharge waiver is capped at Rs. 100 per billing cycle, which might not be sufficient for users with high fuel expenditures.

- GST on Fees:

- All fees are subject to GST, adding to the overall cost of the card.

- Local Cheque Payment Restriction:

- Only local cheques or drafts payable in Delhi are accepted for payment, which might be inconvenient for some users.

Conclusion and Overall Rating

The BPCL SBI Credit Card offers a compelling package for individuals who frequently purchase fuel, particularly at BPCL petrol pumps. Its unique combination of fuel rewards, surcharge waivers, and value-back benefits make it a highly attractive option for those looking to maximize savings on fuel expenses. Additionally, the card provides versatile rewards on groceries, dining, and movies, further enhancing its appeal.

The BPCL SBI Credit Card is highly recommended for frequent BPCL fuel purchasers due to its exceptional rewards and savings on fuel transactions. The additional benefits and features make it a versatile card suitable for various spending categories. Its moderate annual fee, which can be waived with sufficient annual spending, further enhances its value proposition. However, users should be mindful of the reward points cap and the relatively lower reward rate on non-fuel purchases.